When you make a gift of securities to Heart & Stroke, you put stock in knowing you are supporting vital research, health education and advocacy programs.

From funding research breakthroughs that increase cardiac arrest survival rates, to educating at-risk groups about managing their blood pressure, you help create better, healthier lives for thousands of people across Canada.

Download the gift of securities transfer form or send an email to securities@heartandstroke.ca to initiate the process.

If you are an executor, personal representative, estate trustee, liquidator, trust officer, lawyer or individual transferring securities on behalf of an estate or trust, please use the estate transfer of securities form.

Why donate securities?

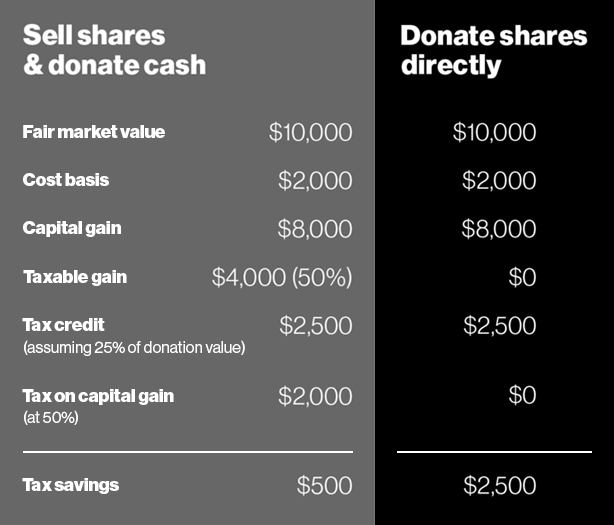

Your gift of securities entitles you to a donation receipt for the full market value (resale) of your contribution. Your gift will result in a non-refundable tax credit that will reduce your income taxes. You can use it in the year of your gift or carry it forward for up to five additional years.

You pay no capital gains tax on the appreciated value (increased price) of your securities. Donating securities directly to Heart & Stroke avoids the tax on capital gains, maximizes the return on your investment and protects the tax credits for use against other taxable income.

The chart below shows the tax advantage when you donate shares to Heart & Stroke instead of selling them and donating the proceeds. This calculation assumes a tax rate of 50%.

Learn more about the benefits of donating securities (PDF).

To initiate your gift, download the form for your province PDF.

All provinces (except New Brunswick)